In a strategic move underscoring the growing role of stablecoins in global finance, Circle and OKX have announced a collaboration to enable seamless one-to-one conversion between US Dollars (USD) and USD Coin (USDC) for over 60 million OKX users worldwide. This development not only improves liquidity and accessibility but also reinforces the infrastructure for mainstream digital asset usage.

USDC Conversion Made Seamless for Millions of Users

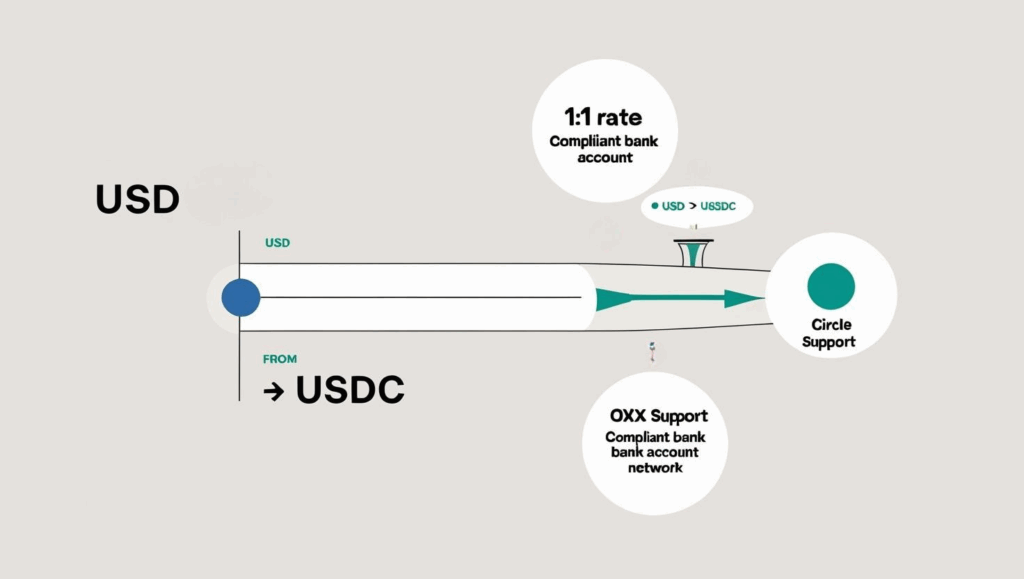

Through this partnership, users will be able to convert USD to USDC and vice versa directly within the OKX app, backed by a robust network of shared banking partners. This streamlining of the on-ramp and off-ramp process removes friction in moving between fiat and crypto, particularly in regions where stablecoins are gaining traction for remittance, trading, and everyday payments.

OKX CEO Star Xu stated the collaboration “enhances the overall user experience and accelerates the adoption of stablecoins in everyday finance.” The initiative includes education and community programs to increase stablecoin literacy and responsible usage.

Regulated, Transparent, and Scalable Infrastructure

Circle, the issuer of USDC, operates through regulated entities and maintains a fully backed 1:1 reserve for every issued USDC. According to Circle CEO Jeremy Allaire, this move expands USDC’s reach while aligning with Circle’s broader goal: building trust in digital dollars and enabling safe, compliant adoption across the globe.

The collaboration also supports Web3 wallet integration, trading, and payments within OKX’s expanding decentralized product suite — further bridging the gap between centralized and decentralized finance.

Stablecoins Demand a Smarter Payment Rail

At Buvei, we see this partnership as a milestone moment in the transition to programmable finance. Stablecoins like USDC are no longer niche—they are rapidly becoming infrastructure-level components of global payments.

Buvei’s infrastructure is designed to support this future:

-

Multi-chain compatibility

-

Compliance-ready stablecoin issuing and settlement flows

-

Programmable card controls and spending policies via API

-

Risk-managed virtual card issuance for Web2 and Web3

For enterprise clients dealing with global subscriptions, ad payments, freelancer payouts, or digital commerce, Buvei offers a compliant, configurable virtual payment stack—ready for the next generation of money.

The Future is Interoperable

As stablecoin ecosystems like USDC integrate more deeply with exchange platforms and wallet providers, the ability to move capital instantly, compliantly, and at low cost will define the winners in the payment space.

👉 Interested in building on stablecoin-powered rails? Contact Buvei today or Request a Demo to explore how our programmable virtual card solutions support global, multi-currency, and digital asset-native payments.